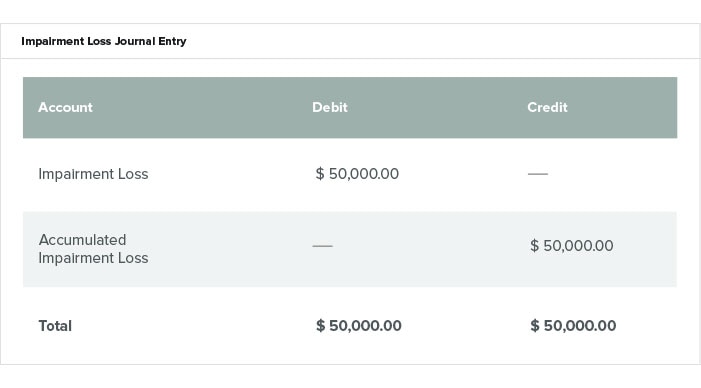

Impairment Loss Journal Entry

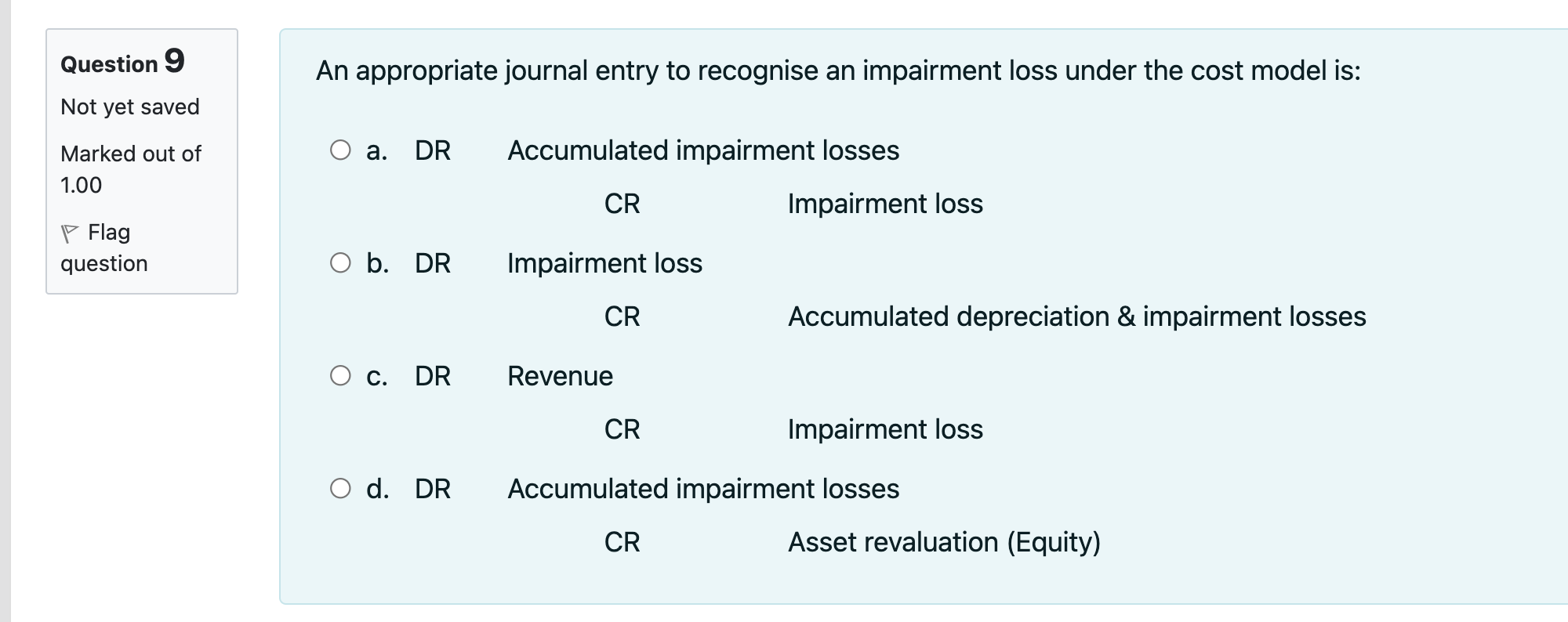

Asset is carried at cost model. Asset is carried at revaluation model and there is a.

Impairment Loss Accounting Impairment Of Assets Held For Use Vs Intended For Disposal Youtube

Journal entry for recording the impairment is the debit to the loss account or to expense account with the corresponding credit to an underlying asset.

. The estimated recoverable amount of the machine is now 120000 the depreciation that would be charged for the asset this financial year is 16000. Overall companies can record impairment loss journal entries as follows. To provision for impairment loss account.

In this journal entry. Please record the journal entry of impairment loss. Dr Impairment loss 10 Cr Accum.

Here is an example of goodwill impairment and its impact on the balance sheet income statement and cash flow statement. The decrease in the fair value in this case is 20000 160000 140000 and as the balance of revaluation surplus is only 18000 in above example the excess amount of 2000 20000. You need to follow AS 28 -impairment of fixed assets for this purpose and journal entry will be- Profit and loss account.

Following an impairment loss subsequent depreciation charge is adjusted to reflect lower carrying amount IAS 3663. Company ABC Limited has identified an impairment loss of 300000 on one of its land which will not be recovered shortly soon. Record journal entries for recognizing impairment loss in the following two scenarios.

Impairment loss is recognized immediately in PL unless the asset is carried at revalued amount Thus entries would be. Based on the report from a technical expert the impairment loss is 50 million. Company BB acquires the assets of company CC.

The journal entry to record the impairment loss would be. Answer 1 of 6. So we need to reduce the balance of fixed assets.

The journal entry to record impairment is straightforward. An impairment loss is recognized through a journal entry that debits Loss on Impairment debits the assets Accumulated Depreciation and credits the Asset to reflect its new lower value. The impairment of accounts double entry is.

On top of that the presentation and disclosures also vary. The amount of the. Recording an impairment loss for an individual asset -.

There is a need though to decrease the reserve balance by 2000 from 15000 in year 2 to 13000 in year 3. In this case the company ABC needs to make the fixed asset impairment journal entry for the impairment loss of 50000 due to obsolescence of its machine as below. The land cost 400000 two years ago.

Depn impairment losses 10. Dr Impairment losses ac PL account. In this journal entry the goodwill which is an intangible asset on the balance sheet of the company ABC will be reduced.

This is an impairment loss. However before recording the impairment loss a company must first determine the recoverable value of the asset. As mentioned the accumulated impairment loss is.

Accounting Treatment For Impairment Of Financial Assets Under Ifrs 9 Download Scientific Diagram

Fixed Asset Accounting Made Simple Netsuite

Accounting For Property Plant And Equipment Reversal Of Impairment Loss Part 1 Youtube

Solved Question 9 An Appropriate Journal Entry To Recognise Chegg Com

Comments

Post a Comment